Depreciation recapture formula

NW IR-6526 Washington DC 20224. The deduction has been limited to definite PE losses.

Depreciation And Income Taxes Prezentaciya Onlajn

We welcome your comments about this publication and your suggestions for future editions.

. The content is suitable for the Edexcel OCR and AQA exam boards. Decreases to basis include depreciation and casualty losses. The specter of having 50 different schedules would be a disaster from a tax complexity standpoint.

This guide explains all tax implications of selling a commercial property. A deduction for any vehicle reported on a form other than Schedule C Form 1040 Profit or Loss From Business. SYD depreciation depreciable base x remaining useful lifesum of the years digits depreciable base cost salvage value Example.

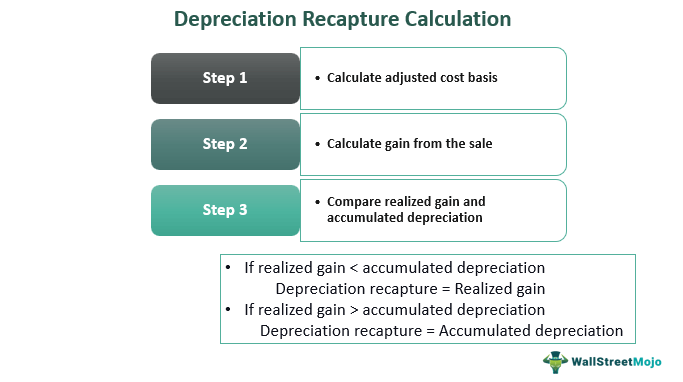

Recapture of depreciation from C corporation years. Di C Ri. As you can see from the above example its quite complicated but you were able to figure out the depreciation recapture amount.

Depreciation recapture and 1031 exchanges. Again the straight line formula is the most common method for calculating. A PAT was used to defer United States federal capital gains tax on the sale of an asset to provide a stream of.

Then the depreciation figures decrease as time goes by. Macrs depreciation schedule Recapture How Residential Rental Property Depreciation Works What Properties Are Depreciable Rental Property Depreciation Method Rental Property Depreciation. Starting net book value x Depreciation rate.

We will also discuss capital loss and how it works to offset the Capital Gains Tax. Calculating Depreciation Using the 150 Percent Method. The 150 percent depreciation rate is calculated the same way as the straight-line method except that the rate is 150 percent of the straight-line rate.

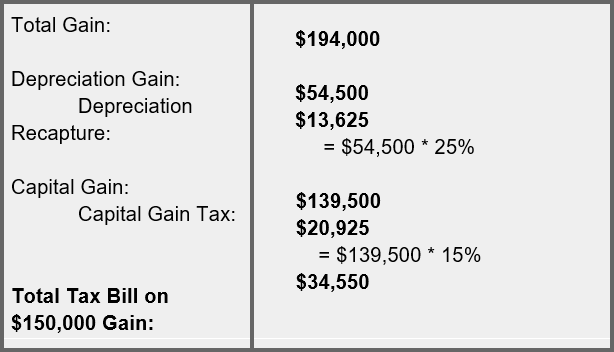

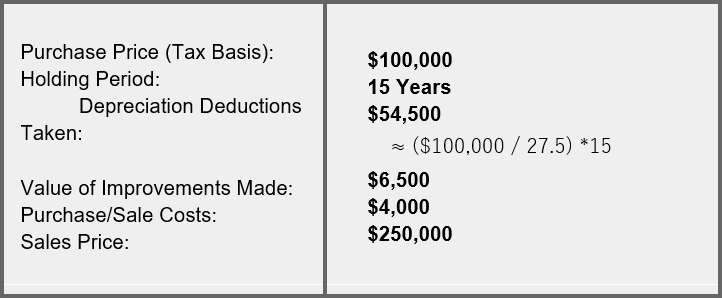

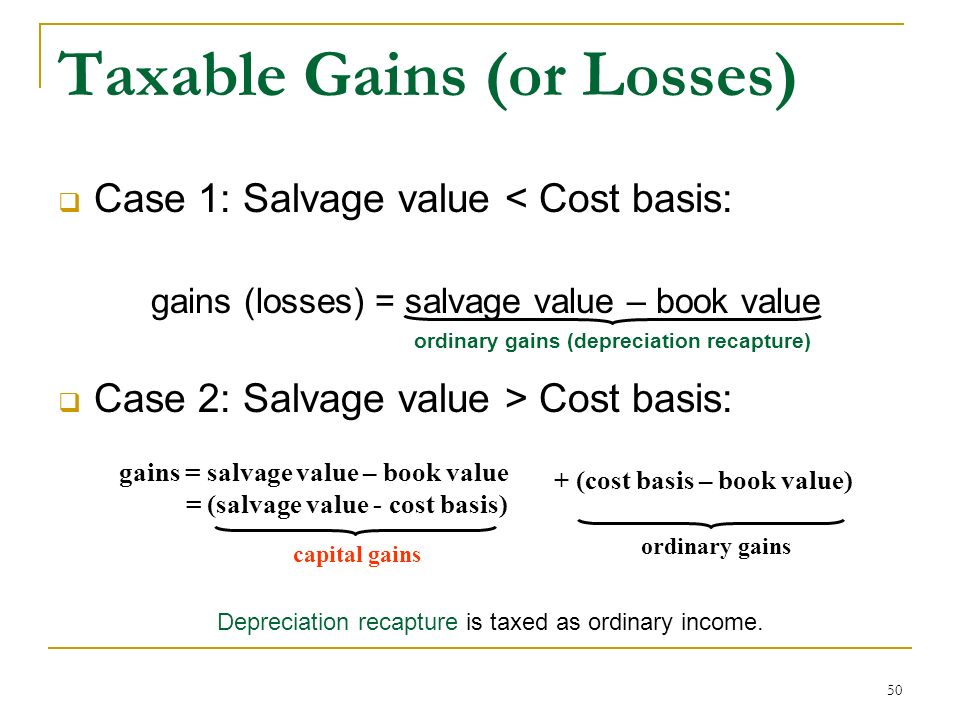

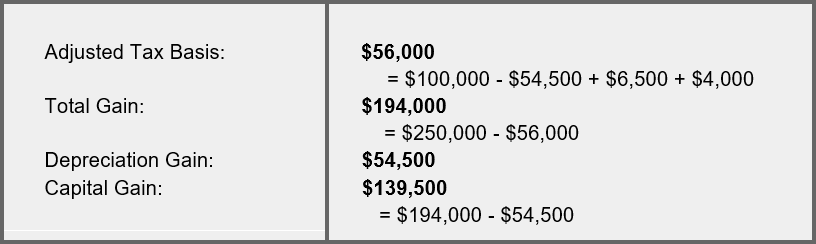

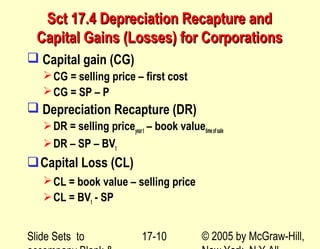

You may have to report the recognized gain as ordinary income from depreciation recapture. The depreciation recapture amount will be 61600. The formula for depreciating commercial real estate looks like this.

Federal Capital Gains Tax CGT long-term and short-term state taxes and depreciation recapture. What the IRS gives the IRS will eventually take back in the form of depreciation recapture. The deductibility of car costs and fuel costs is calculated based on the following formula.

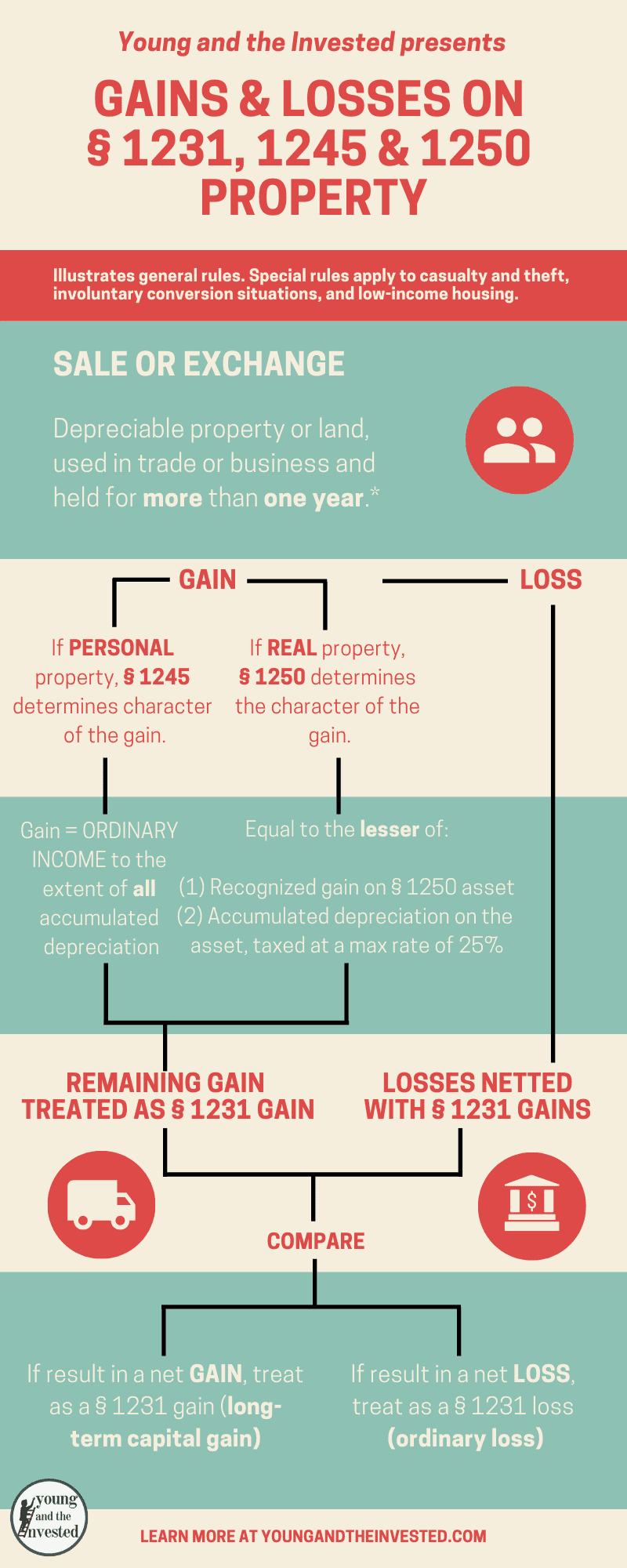

The rest of your sale value will be taxed at a lower tax rate that applies to 1231 properties. The ordinary income assets consist of unrealized receivables and inventory items that have appreciated substantially in value1 An explanation of these assets follows. 6 to 30 characters long.

Cash capital assets and 1231 assets to the extent in excess of depreciation recapture and generally any assets the sale of which produce capital gains or losses. If an asset has original cost of 1000 a useful life of 5 years and a salvage value of 100 compute its depreciation schedule. Depreciation and amortisation.

1 training and experience 2 duties and responsibilities 3 time and effort devoted to business 4 dividend history 5 payments to nonshareholder employees 6 timing and manner of paying bonuses to key people 7 what comparable businesses pay for similar services 8 compensation agreements and 9. The federal modifications to depreciation limitations on luxury automobiles IRC Section 280F. Reduce the amount figured in Step 1 by any section 1250 ordinary income recapture for the sale.

The exclusion of a patent invention model or design and secret formula or process from the definition of capital asset. Record the annual depreciation. When commercial real estate is sold the difference between the basis and the sales price must.

The formula to calculate depreciation under SYD method is. The straight-line depreciation formula is. New Yorks recapture provision is the most damaging and results in an approximately.

You can avoid depreciation recapture altogether through a 1031 exchange. The vast array of federal depreciation schedules is by itself a tax complexity nightmare for businesses. 1231 property is real or depreciable business property held for more than one year.

In addition to that you will learn about the ways to. Recapture premiumaccounts for net land appreciation Risk premium reveals the overall risk exposure of the real estate market It is very straightforward to perform this calculation. Must contain at least 4 different symbols.

To calculate use this formula. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Use the double-declining balance depreciation rate which is double that of the straight-line depreciation rate.

Income from unreplaced last-in first-out LIFO inventory from C. In the sale or exchange of a portion of a MACRS asset discussed later the adjusted basis of the disposed portion of the asset is used to figure gain or loss. Section 1245 Depreciation Recapture Rules.

Prior to 2006 a private annuity trust PAT was an arrangement to enable the value of highly appreciated assets such as real estate collectables or an investment portfolio to be realized without directly selling them and incurring substantial taxes from their sale. Depreciation on any vehicle or other listed property regardless of when it was placed in service. A 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred and paid at a later time.

Allowance of Federal ACRS and MACRS Depreciation. Under depreciation recapture rules the amount of money you depreciated will be taxed at a higher ordinary income tax rate. It gives larger depreciation figures at the beginning.

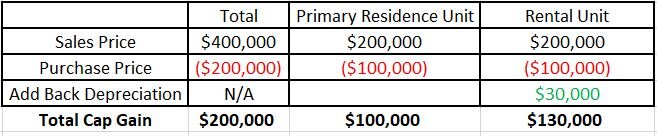

One of the benefits of having a rental is the ability to claim depreciation on the property which allows you to offset rental income that would otherwise be taxed as ordinary income. You will learn about the types of taxes you have to pay. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

MACRS Formula Using GDS Cost basis of the asset x Depreciation rate. In addition the recapture rule only comes into play if the losses were set. Cost of property Land value Basis.

Figure the smaller of a the depreciation allowed or allowable or b the total gain for the sale. Is if you converted your home into a rental when the market value of the property was below your adjusted basis per the formula. So now you know how much you will pay when you sell a property and you can decide if.

Any depreciation on a corporate income tax return other than Form 1120-S. 30 The factors are as follows. This is the smaller of line 22 or line 24 of your 2021 Form 4797 or the comparable lines of Form 4797 for the year of sale for the property.

Depreciation recapture allows the IRS to collect taxes on the sale of an asset that a business had previously used to offset its taxable income through wear tear and operating expenses. Free online GCSE video tutorials notes exam style questions worksheets answers for all topics in Foundation and Higher GCSE. 120 05 x coefficient x number of grams CO2km whereby the coefficient equals.

The formula is the cost of the property divided by its useful life. ASCII characters only characters found on a standard US keyboard. There are a few things to note here.

Amortization of costs that begins during the 2021 tax year. Our macrs depreciation calculator uses the given macrs formula to perform macrs calcualtion. If that sounds complicated it isbut well provide examples later.

Depreciation cost - salvage value years of useful life.

Learn About Depreciation Recapture Spartan Invest

Learn About Depreciation Recapture Spartan Invest

Do I Have To Pay Tax When I Sell My House Greenbush Financial Group

Contributed Property In The Hands Of A Partnership

Depreciation Recapture Meaning Calculation Tax Rate Example

1031 Exchange And Depreciation Recapture Explained A To Z Propertycashin

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

Macrs Depreciation Calculator Straight Line Double Declining

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

Chapter 8 Depreciation And Income Taxes Ppt Video Online Download

Depreciation And Income Taxes Asset Depreciation Book Depreciation

Capital Gains And Losses Sections 1231 1245 And 1250

Learn About Depreciation Recapture Spartan Invest

Like Kind Exchanges Of Real Property Journal Of Accountancy

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Chapter 17 After Tax Economic Analysis

How To Use Rental Property Depreciation To Your Advantage